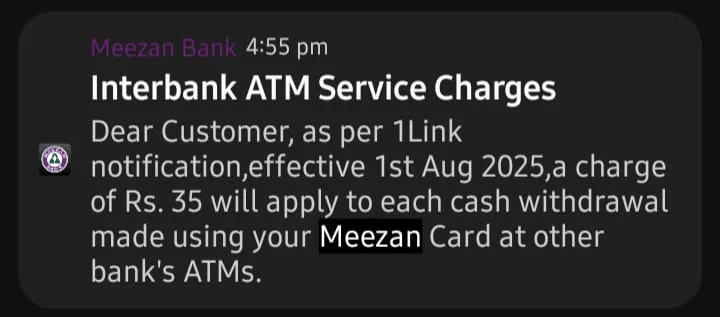

Pakistani banks have notified customers via email and in-app alerts that withdrawing cash from other banks ATMs will now cost Rs 35 per transaction. The increase will take effect from 1st August 2025, as per notifications received by users from banks in Pakistan.

Why Trust Pakera.pk?

At Pakistan Era, we share information that is true, clear and tested by ourselve. Everything we publish is thoroughly checked, so you can trust what you read at our platform. Our goal is to keep things simple and reliable. We make sure that you get the best and most accurate facts to make the best decision or understand a topic!

Jump to Section

Previous Other Bank ATM Withdrawal Fee

- Previous fee: Rs 23.44 per non-host ATM withdrawal

- New fee: Rs 35 (effective from 1st August 2025)

Banks say this is due to revised 1LINK interbank fee structure, and change is clearly outlined in their updated fee schedules.

What is 1Link?

1LINK is Pakistan largest interbank ATM and payment network. It was set up in 1999. It helps enables real time Inter Bank Funds Transfer (IBFT), shared via ATM services and POST Terminals, and powers domestic debit schemes like PayPak

Read How to Block ATM Card in Pakistan

Why Banks Charge Extra Fee on Other Banks ATM Withdrawal

- ATM-owning bank receives Rs 28, this covers upkeep, cash management, and operational costs.

- 1LINK, which is interbank ATM switch, gets Rs 7 per non host transaction for its service and network.

1LINK connects over 14,000 ATMs across 37 member banks in Pakistan, it is mandated by the State Bank of Pakistan to ensure easy and quick interbank access throughout Pakistan.

What It Means for ATM Card Users in Pakistan

Try to use own bank’s ATM for no extra charges. Using another bank’s ATM will charge extra Rs 35 each time. Frequent withdrawals will make noticeable costs, especially for smaller transactions.

Pakistani Public Take on this Increase

Banking experts say due to rising operational costs and network management, this hike was important to keep providing seamless services. But criticism is growing, as citizens use non-host ATMs in rural or underserved areas, where own bank ATM are not available and withdrawing is difficult. Some describe this as a “hidden tax on cash,” on wage earners and low-income individuals.

Read How to Enable and Use Bank Alfalah Tap to Pay

How to Avoid Inter Bank ATM Withdrawal Fee

- Always withdraw from own bank ATM.

- Use digital wallets, mobile banking, or POS to avoid cash charges.

- Track ATM usage limits, some banks allow limited fee free interbank withdrawals per month.

Banks That offer Free interbank ATM Withdrawals per Month

Most banks in Pakistan offer limited free ATM withdrawals from non host ATMs each month. The free limit varies by bank.

| Bank | Free Interbank ATM Withdrawals/Month |

|---|---|

| HBL | 3 to 5 |

| UBL | 3 |

| Bank Alfalah | 3 to 5 |

| Meezan Bank | 3 |

| Easypaisa Debit Card | 1 |

| SadaPay | 3 Free Withdrawals from Any ATM |

| JazzCash Mastercard | 0 (Charges apply per withdrawal) |

📢 Want exclusive content, quick updates, and alerts straight to phone? Join Pakistan Era WhatsApp Channel for free.

Quick FAQs

No, fee only applies to cash withdrawals from another bank ATM. Swiping card at store using POS machine will not charge extra Rs 35. POS transactions remain free for customers.

3 free ATM withdrawals from any bank ATM per month. After free usage, Rs 35 fee is charge per withdrawal, including the 1LINK interbank fee. Yes, Digital wallets like Sadapay/nayapay users will also pay Rs 35 per withdrawal after using their free quota, just like regular banks.

No, as per 1LINK and bank policies: Balance inquiry at another bank ATM costs Rs 3 to Rs 5, not Rs 35. Mini statement printouts cost Rs 5 to Rs 10 depending on bank.

Track free ATM usage in banking app, Withdraw from own bank’s ATM, Use digital transfers (e.g., Easypaisa, Raast, IBFT), or Use POS terminals for shopping instead of withdrawing cash

Disclaimer: This article is for informational purposes only. We are not affiliated with anyone mentioned above and their partners..

Umer Kureshi is the Lead Administrator with a strong background in technology and digital marketing. As the Lead Administrator, and Writer at Pakera.pk, Umer manages the website operations, optimizes website content and writes engaging guides on technology and current events happening in Pakistan.

Currently, Umer is pursuing a Bachelor’s in Management Studies from Government College University, Lahore. Umer combines his academic insight, knowledge, and critical thinking with practical experience to give impactful results. Umer also contributes to Xfilink Pvt Ltd as the Lead Writer of Content Writers Team and to Technology Elevation, where he looks over affiliate marketing, web design, technical writing and proofreading.

In his free time, Umer stays active and energetic by regularly participating in sports and outdoor activities, combining his athletic spirit with a passion for staying sharp and focused.