The NTN (National Tax Number) is as important as CNIC for all people and businesses in Pakistan. No matter if you are salaried person or a businessperson or a government employee, an NTN number helps in making life easy when it comes to compliance with the law related to the filing of taxes.

And we hope this guide will help through the entire process of getting an NTN number, NTN Certificate and how to download it, Check verification status, and required documents as a Pakistani and overseas Pakistani.

In a Hurry to Get Your NTN Number in Pakistan? Follow These Steps:

- Go to the FBR Iris Portal.

- Register/Create an account on the portal.

- Log in to the portal.

- Fill out the Taxpayer Registration Form online.

- Submit the form online.

- Wait for verification from FBR.

- If approved, FBR will issue your National Tax Number (NTN).

Why Trust Pakera.pk?

At Pakistan Era, we share information that’s true and clear. Everything is properly checked before we publish, so you can trust what you read. Our goal is to keep things simple and reliable, making sure you get the best and most accurate facts to make the best decision!

Inside of NTN Number Guide in Pakistan

- Why You Need an NTN Number?

- How to Get NTN Number from FBR Website (Full Method)

- Benefits of Having an NTN Number in Pakistan

- FBR Taxpayer Registration Form

- How to Get NTN Certificate

- How to Get NTN Number from CNIC

- How to Get NTN Number for Business in Pakistan

- NTN Number for Salaried / Government Employee

- Get NTN Number for Overseas Pakistani

- How to Check Your NTN Status Online

- Quick FAQs

Why You Need an NTN Number?

Before you get into the process of applyinh National Tax Number, it is important to understand i why you need it as a Pakistani Citizen:

- Legal Requirement: It is a legal requirement of every ctizen to obtain NTN either For individuals and businesses in Pakistan to file tax returns.

- Financial Transparency: The NTN help in financial transparency and allows you prove that you are a tax payer legally.

- Eligibility for Government Contracts: Many government tenders and contracts require an NTN. If you are a business or contractor, you should get an NTN.

- NTN Certificate: It also provides proof of your tax registration, which may be needed for certain financial dealings.

Read How to Pay Token Tax Online

How to Get NTN Number from FBR Website (Full Method)

The Federal Board of Revenue (FBR) in Pakistan has made it easy to apply for an NTN number online. Here’s a step-by-step guide:

- Go to the FBR Iris Portal.

- Click on the “New Registration” option.

Enter your CNIC number, set passport and enter CAPTCHA code displayed on the screen

- Log In to FBR Iris

After registration, you’ll receive a confirmation email with your login credentials.

- Fill Out the Taxpayer Registration Form

For Individuals: Income sources, personal data, and employment details (if applicable)

For businesses: Business address, nature of business, and type of business entity - Submit the Application

Submit for approval after completion. FBR will verify your details and, once verified, issue your NTN Number. You will receive a notification via email or SMS.

Benefits of Having an NTN Number in Pakistan

- Legal Compliance

- Simplified Tax Filing

- Financial Benefits

- Access to Government Contracts

- Smooth Business Transactions

Benefits of Filing Your Taxes After Getting Your NTN

- Maximized Tax Advantages

- Legal Obligation Fulfillment

- Lower Tax Rates

- Government Incentives

- Improved Financial Standing

Read How to Become Tax Filer in Pakistan Today

FBR Taxpayer Registration Form

Required Documents to Submit with FBR Taxpayer Registration Form:

To submit the Taxpayer Registration Form (TRF-01) for an NTN number, you need the following documents:

- Any Additional Documents required for business activities or authorized representatives.

- CNIC/Passport Number

- Proof of Address (utility bill or rent agreement)

- Bank Account Details (business or personal accounts)

- Business Registration Documents (if applying for a business NTN)

- Contact Information (phone number & email)

How to Get NTN Certificate

After getting your NTN number, you can download your NTN certificate for proof. Here’s how:

- Log in to your FBR Iris Account.

- Go to the “Taxpayer Profile” section.

- Click on the “Download NTN Certificate” option.

- Your NTN certificate will download, now you can print or share it for the records.

Read How to Apply for passport in Pakistan,

How to Get NTN Number from CNIC

For individuals who want to know their NTN number from CNIC, follow these steps:

- Visit the FBR Taxpayer Verification Portal.

- Enter CNIC without dashes.

- Click Search

- Check result (If you are already registered, your National Tax Number will be displayed)

- Copy and Save your NTN Number

If your NTN Number does not show in the result, you will need to register as by following the above steps.

How to Get NTN Number for Business in Pakistan

If you’re a business owner, you need an NTN for legal tax filing and compliance. The process is similar to that of individuals, with the following additional requirements:

- Business Details (business name, type of business and business address)

- Bank Account (registered in your business name)

- Documentation (business licenses, bank statements, and proof of business activities)

Read How to Check MTag ID Number in Pakistan Online

NTN Number for Salaried / Government Employee

Salaried individuals in Pakistan either private employee or government employee, both can get their National Tax Number, which is important for filing tax returns and other financial activities. Here how to get NTN online:

- Go to FBR Iris Portal

- Register on the FBR Iris portal as an individual using CNIC

- Select “Salary” as your income source.

- Enter your employer/Company details and salary information accurately

- Submit your form to receive your NTN number.

Get NTN Number for Overseas Pakistani

If you are an overseas Pakistani, you can still apply for an National Tax Number through the following steps:

- Go to FBR Iris Portal

- Register using your Pakistani CNIC, like a resident

- Declare your income earned abroad with any taxable income earned within Pakistan.

- For Verification, submit additional documentation for overseas earnings, such as tax returns from the foreign country or bank statements.

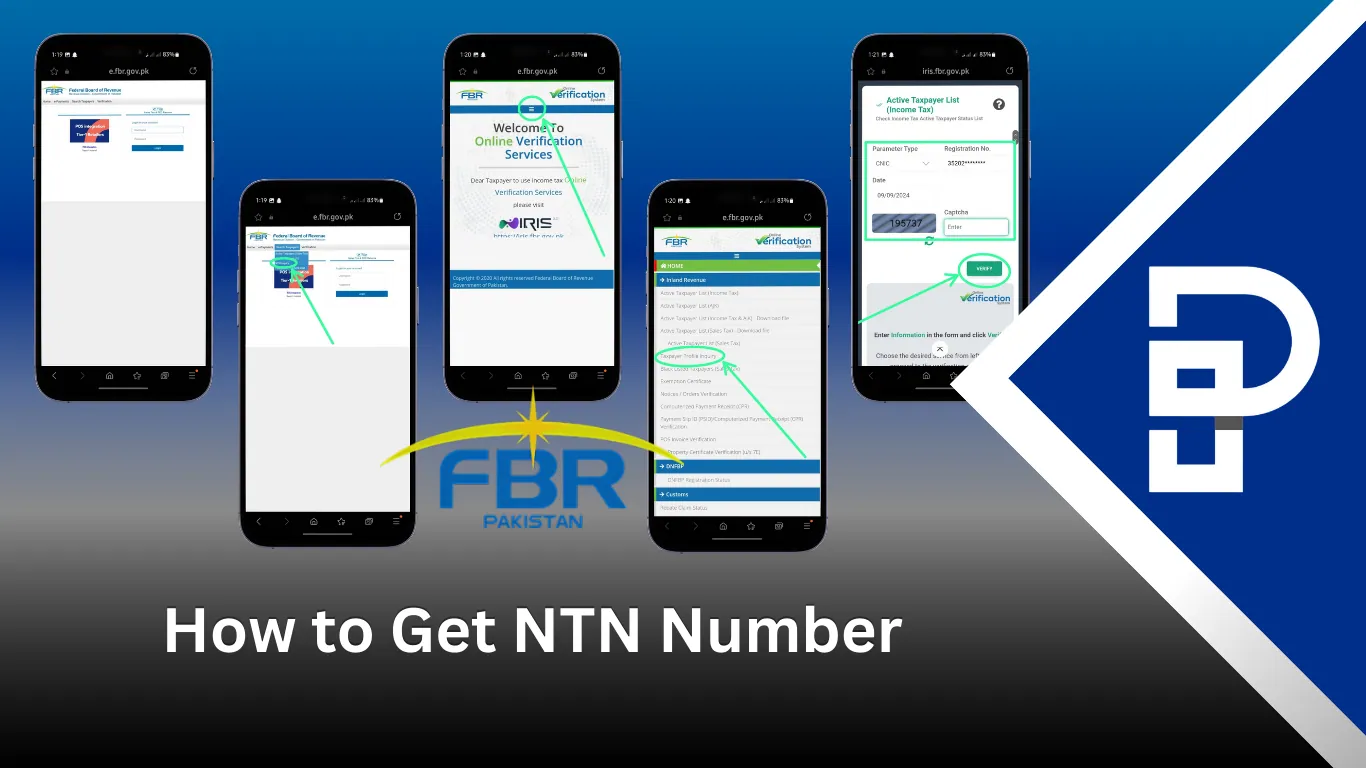

How to Check Your NTN Status Online

After applying, there is a verification by FBR and then they issue NTN. And To check your NTN verification status online, follow these detailed steps:

1. Visit the FBR Website

Open your browser and go to the FBR website by visiting e.fbr.gov.pk.

2. Access the Search Taxpayer Option

Once the page loads, long press on the “Search Taxpayer” option located in the top menu.

3. Select NTN Inquiry from Dropdown

After holding, a dropdown menu will appear. Click on NTN Inquiry from the options.

4. Tap the Three-Bar Menu

On the next page, tap the three-bar menu at the top of the page to open additional options.

5. Select Taxpayer Profile Inquiry

From the left-hand menu, click on Taxpayer Profile Inquiry to proceed.

6. Enter Your Information

- Parameter Type: Select CNIC, NTN, or Passport No

- Registration Number: Enter your CNIC or Passport Number

- Enter the captcha code displayed on the screen.P

- Press Verify to view your NTN status.

By following these steps, you can easily verify your NTN status and review your taxpayer profile online.

Join Our Whatsapp Channel To Stay Informed

Quick FAQs

1. CNIC or NICOP (for overseas Pakistanis)

2. Proof of business or employment (if applicable)

3. Business registration documents (for business entities)

4. Contact details and address

5. Proof of overseas income (for overseas Pakistanis)

After submitting your application on the FBR Iris portal, it can take up to 2 to 3 working days for FBR to verify and issue your NTN number.

Once FBR issued your NTN number, log into the FBR Iris portal, Go to the Taxpayer Registration section, and update your employer details (name, address and contact information of your employer)

Umer Kureshi is the Lead Administrator with a strong background in technology and digital marketing. As the Lead Administrator, and Writer at Pakera.pk, Umer manages the website operations, optimizes website content and writes engaging guides on technology and current events happening in Pakistan.

Currently, Umer is pursuing a Bachelor’s in Management Studies from Government College University, Lahore. Umer combines his academic insight, knowledge, and critical thinking with practical experience to give impactful results. Umer also contributes to Xfilink Pvt Ltd as the Lead Writer of Content Writers Team and to Technology Elevation, where he looks over affiliate marketing, web design, technical writing and proofreading.

In his free time, Umer stays active and energetic by regularly participating in sports and outdoor activities, combining his athletic spirit with a passion for staying sharp and focused.

One thought on “How to Get NTN Number”