Easypaisa brings easy, secure, and on-the-go mobile banking that allows you to transfer funds, pay your utility bills, subscribe network packages and do easy load to your sim. Below we are going to cover how to create easypaisa account and register with various networks such as Telenor, Jazz, Ufone, Zong, Warid, Onic, and Scom.

Create Your Easypaisa Account in 2 Minutes

- Open the App & Select ‘Sign Up’

- Enter Your Mobile Number (any network) and tap Next.

- Verify Your Number by entering the OTP sent to your number.

- Enter Your CNIC Details (CNIC number and issue date)

- Set Up a 5-Digit PIN

- Confirm & Start Using

You have created level 0 account, Verify your biometric to unlock more benefits and gain greater control.

Why Trust Pakera.pk?

At Pakistan Era, we share information that’s true and clear. Everything is properly checked before we publish, so you can trust what you read. Our goal is to keep things simple and reliable, making sure you get the best and most accurate facts!

Table of Contents

- Create Your Easypaisa Account in 2 Minutes

- Background of Easypaisa in Pakistan?

- Types of Easypaisa Accounts

- Benefits of Having an Easypaisa Account

- Requirements for Opening an Easypaisa Account

- Create Easypaisa Account without Easypaisa App

- Create Easypaisa Account on Mobile App

- Verifying Your Easypaisa Account

- How to Add Funds in Easypaisa Account

- Benefits of Easypaisa Account

- Easypaisa Customer Helpline

- Easypaisa vs JazzCash

- People Also Asked Questions

Create Your Easypaisa Account in 2 Mins

Background of Easypaisa in Pakistan?

Easypaisa came in 2009 in Pakistan. Easypaisa is the first ever mobile banking platform in Pakistan, that came through a partnership of Telenor and Tameer Microfinance Bank. It was a game changer in digital payments and enabled users to carry out financial transactions in the comfort of their phones.

With Easypaisa, everyone experienced control over their financial services like money transfer, payment of bills, buying mobile packages, and much more without having a need bank account. All of these services are available via a very user-friendly app on both Android and iOS.

Join Our Whatsapp Channel to stay informed and updated.

Easypaisa Becomes Pakistan’s First Digital Bank

Easypaisa is now Pakistan’s first officially recognized Digital Bank by state bank of Pakistan. With the commercial approval, Easypaisa Digital Bank is now positioned as the leading mobile banking service against Jazzcash and others, by offering a more secure and innovative digital banking experience to millions of Pakistanis.

As a digital bank, Easypaisa is more capable of expanding its services for its users, improving financial inclusion and benefits, and also by introducing new banking solutions to customers without the need for physical traditioned bank branches.

Types of Easypaisa Accounts

Easypaisa offers several types of accounts to cover different needs:

- Personal Accounts

- Merchant Accounts

- Business Accounts

- Asaan Digital Account

- New Gen Account

- Level 0 & Level 1 Accounts:

Benefits of Having an Easypaisa Account

Creating an Easypaisa account opens up a world of convenience. Here are some benefits:

- Accessibility: Perform transactions from anywhere in Pakistan without visiting a bank.

- Range of Services: From paying utility bills to transferring money internationally, Easypaisa covers it all.

- Security: Your transactions are secured with multiple layers of protection, including PIN and biometric verification.

Requirements for Opening an Easypaisa Account

To open an Easypaisa account, you’ll need:

- A valid Computerized National Identity Card (CNIC)

- A mobile number (any network)

- An active SIM card registered in your name

Create Easypaisa Account without Easypaisa App

If you don’t have a smartphone, you can still create Easypaisa account without App. Here how:

For Telenor Users

Via USSD Code:

- Dial *786# on your phone.

- You’ll be prompted to create a 5-digit PIN code.

- Re-enter the PIN for confirmation, and your account will be created.

From Telenor Franchises:

- Visit any Telenor franchise or Easypaisa retailer with your CNIC and phone.

- They will assist you in setting up your account.

For Non-Telenor Users (Jazz, Ufone, Zong, Warid, Onic, Scom)

Via SMS:

- Send an SMS to 0345-1113737 with ‘EP <space> Your CNIC Number’.

- You will receive a call from an Easypaisa representative for verification.

- After verification, create a 5-digit PIN code by sending ‘PIN <space> Your PIN <space> Confirm PIN’ to 0345-1113737.

- Wait for the confirmation SMS that your account is active.

Visit Easypaisa Retailers:

- Visit any Easypaisa retailer with your CNIC and phone for assistance in setting up your account.

Create Easypaisa Account on Mobile App

First Download the App (Get the Easypaisa app from Google Play Store or the App Store.)

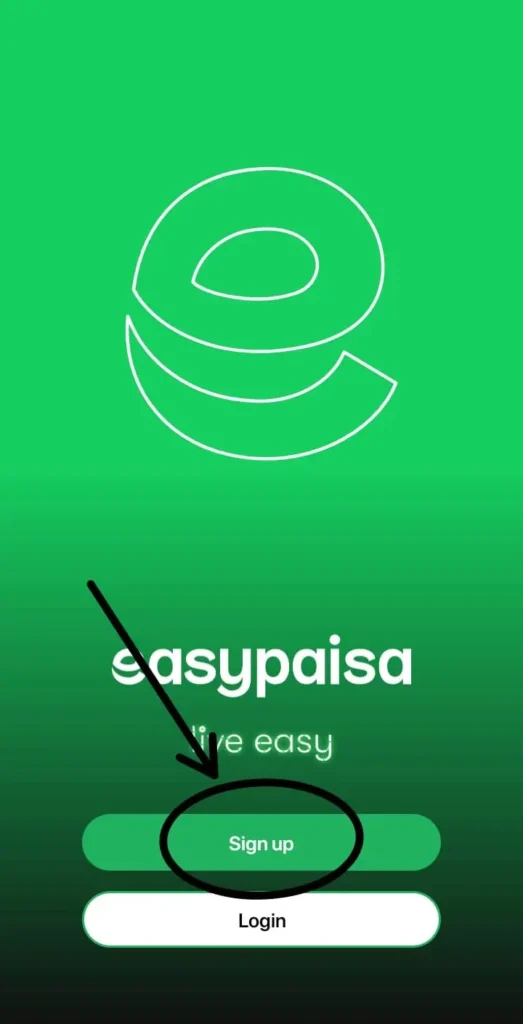

- 1: Open the Easypaisa app on your phone and click on “Sign Up”.

- 2: Choose which account you want to open: Basic Account or Digital Asaan Account.

- 3: Enter your mobile number.

- 4: Click “Verify”.

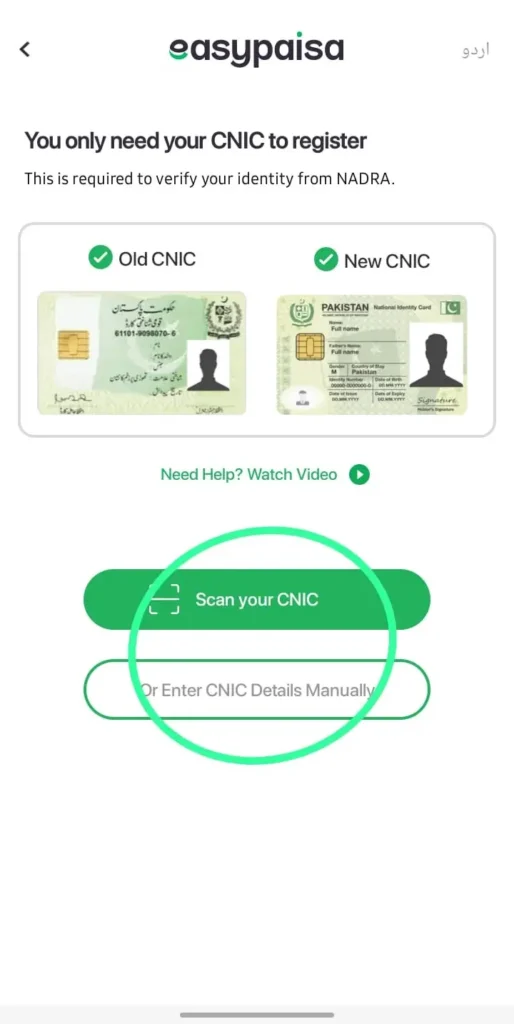

- 5: Enter your CNIC details manually or by scanning the front and back of your CNIC.

- 6: Set up your login PIN.

- 7: Complete your sign-up and enjoy endless features and perks!

Verifying Your Easypaisa Account

Verification is crucial for security and accessing all features. You will need to confirm your identity through SMS or a call, and sometimes an in-person verification at a Telenor franchise or Easypaisa retailer.

How to Verify Biometric on Easypaisa App

Biometric verification adds an extra layer of security to your Easypaisa account. Here’s how to do it:

- Open the Easypaisa app and log in to your account.

- Navigate to the settings menu and select the ‘Biometric Verification’ option.

- Follow the on-screen instructions to scan your fingerprint or face.

- Once the biometric data is successfully captured, your account is biometrically verified, enhancing your account’s security.

Common Issues Faced by Everyone

Biometric Verification Failed or NADRA Doesn’t Recognize It?

This can happen sometimes due to an error or a network issue with NADRA’s verification system, causing the recognition to fail in their database. We advise you to keep trying and also clean your fingertips if they are not clean.

Phone Doesn’t Recognize Finger prints Even with Flash On

If your phone doesn’t recognize your fingers or thumb, try using another phone’s flashlight directly on your fingers, then scan again. In our experience, we always use two phones. One for scanning and one for extra lighting if there’s no direct light.

How to Add Funds in Easypaisa Account

To make transactions, you need to deposit money into your Easypaisa account. Here are the methods:

- Bank Transfers: Use your bank’s online portal to transfer money to your Easypaisa account. Add yourself as a beneficiary and select Telenor Microfinance Bank.

- Easypaisa Shops: Visit any Easypaisa retailer to deposit cash into your account.

- Other Methods: Transfer money from another Easypaisa account or use your debit/credit card.

Benefits of Easypaisa Account

With an Easypaisa account, you can:

- Transfer Money: Send money to any bank account, mobile number, or Easypaisa account.

- Pay Bills: Easily pay utility bills from the comfort of your home.

- Mobile Top-ups: Recharge your mobile balance or someone else’s with ease.

Advanced Features of Easypaisa

Easypaisa offers a range of advanced features that go beyond basic transactions:

- Short-term Loans: Dial 7867# to apply for an instant loan of up to PKR 10,000.

- Insurance Services: Choose from various insurance options directly within the app.

- International Transfers: Send money abroad securely and efficiently.

Easypaisa Customer Helpline

You can talk with an Easypaisa customer care representative by calling (042/021/051)-111-003-737, or you can file a complaint in the app, and a customer representative will call you shortly to help you with your issue.

People Also Ask Questions

Easypaisa Helpline Not Responding or Connecting?

If your call isn’t connecting to the Easypaisa Punjab helpline, try calling other helpline numbers, it will connect. We faced a lot of issues connecting with the 042-111-003-737 Easypaisa helpline, but when we tried calling 021/051-111-003-737, it got through, and we were able to lodge our complaint.

What is my Easypaisa Account Number?

Your Easypaisa account number is your mobile number from which you created your Easypaisa account.

Easypaisa vs JazzCash

| Feature | Easypaisa | JazzCash |

|---|---|---|

| Network | All networks | All networks |

| Bank Transfers | Yes | Yes |

| Retailers | Widely available | Widely available |

| International Transfers | Yes | Limited |

| Loan Services | Yes | Yes |

| Security | PIN & Biometric | PIN & Biometric |

| Digital Banking License | Yes | No |

People Also Asked Questions

A valid CNIC is required to create an Easypaisa account.

Easypaisa is now officially a complete commercial digital bank approved by State bank of Pakistan.

Open the Easypaisa app > Login > Tap the top-left icon > Select Account Level > Press Upgrade Account > Follow the prompts to set up a Digital Asaan Account.

Open Google Play Store on your phone, search for the Easypaisa app, and click ‘Install’.

No, there is no such requirement of easypaisa in account creation process. All you need is a valid CNIC, a mobile number registered on your CNIC.

Open the App Store on your iPhone, search for the Easypaisa app, and tap ‘Get’ to download and install.

You can delete your Easypaisa account by calling their helpline. After connecting with the customer care representative, tell them that you want to delete your Easypaisa account. After confirming your identity, the customer care representative will delete your account shortly.

In the end, Easypaisa is one of the safest, and most reliable digital banking platform out there in Pakistan. With its new status as Pakistan’s first ever officially approved Digital Bank, Easypaisa digital banking, can provide seamless and secure financial solutions to millions. Either you are in to need to transfer money, pay utility bills, or shop online, Easypaisa offers a complete digital banking experience. create your account now and take full control of your finances with just a few taps on your mobile phone!

5 thoughts on “How to Create Easypaisa Account”