Losing Important ATM card can put your hard earned moey in to risk, but it is not the only concern. Having debit or credit card added to various online shopping or social media platforms with automated subscription plans can cause you financial lose. Sometimes money gets deducted without us knowing it because of the subscription or hacked accounts. That is just as stressful as it sounds. But do not worry, we have all been there (your author included) and panicked because we did not know how to block our ATM card!

In a Hurry to Block Your ATM Card? Follow these steps:

- Open your bank app (for the card you want to deactivate).

- Log in to your account.

- Go to Card Management.

- Select the card you want to block.

- Deactivate the card by toggling it off.

- Card deactivated! You can reactivate it later by following the same steps.

If this method doesn’t work for your bank, click on your bank name below for a step-by-step guide with screenshots:

Why Trust Pakera.pk?

At Pakistan Era, we share information that’s true and clear. Everything is properly checked before we publish, so you can trust what you read. Our goal is to keep things simple and reliable, making sure you get the best and most accurate facts to make the best decision!

Recently, there have also been cases of fraud, with Meezan Bank customers reporting unauthorized charges on social media platforms. Situations like this highlight why it’s so important to deactivate your card to safeguard your money.

The good news is that controlling your card is simple. Whether your card is lost, stolen, or being misused online, blocking it quickly is the safest way to protect your money. In Pakistan, banks like HBL, Meezan, and JazzCash make this process easy with apps, helplines, and branch support.

Join Our Whatsapp Channel To Stay Informed and Updated

Watch the Step-by-Step Guide

For a quick guide on how to block an ATM card in Pakistan, check out our video tutorial below. It provides simple instructions to get it done in no time.

Deactivate in 4 Steps (30 Seconds)

Why You Should Block Your ATM Card

This incident happened in Lahore: with one of our team members who lost his wallet but did not know it right away. Someone found it, took the ATM card, and used it online where no OTP or PIN was needed. Worse, they guessed the PIN, which was something simple like 1111, 1234, or 0000, and withdrew money from an ATM!

Similarly, there have been recent cases of fraud involving Meezan Bank and other bank customers. Unauthorized charges were made on their cards through social media platforms, highlighting how easily your money can be misused even when your card isn’t physically lost.

This is why you should block your atm card right away after using it or if it get lost or stolen. Blocking your card will:

- Keep your money safe from bad people.

- Stop others from using your card.

- Let you get a new card quickly from the bank.

If your card goes missing, tell your bank right away to keep your money safe!

Learn How to Use Google Wallet in Pakistan

How to Block Your ATM Card in Pakistan Without App

If you do not have access to your Bank App, Block your Card by following steps tailored for each bank in Pakistan:

Meezan Bank

Call Meezan Bank Helpline at 111-331-331 or 111-331-332 to block your card or Visit nearest Meezan Bank branch if you can’t call or connect on helpline.

HBL (Habib Bank Limited)

Call HBL Helpline on 111-111-425 to block your card. or Visit HBL branch.

UBL (United Bank Limited)

Call UBL Helpline by dailing 111-825-888 for instant card blocking.

JazzCash eWallet

Call Jazzcash Helpline at 4444 (Jazz users) or 111-124-444 (other networks).

What to Do After Blocking Your Card

- Ask for a New Card if Previous one stolen or damaged

- Check Your Account Bank statement for any Unusual transaction. If found any, call at helpline and launch a complain for reverse

- Update Your Subscriptions for payment with the new card (Netflix, Xbox Pass, Etc)

Step by Step Block ATM Card Using Mobile App (with Screenshots)

Block Meezan Bank ATM Card Using the App

Blocking Meezan Bank ATM Card is easy and quick with its mobile app. Just follow these steps:

1: Log In to the Meezan App

- Open the Meezan Bank app on your phone.

- Login with username & password or use TouchID / FaceID to log in.

2: Go to the Debit Card Section

Tap on the Debit Card icon from Main page.

3: Block Your Card

Slide toggle switch to opposite direction to deactivate your card.

4: Confirm the Block

Wait for the pop up message with confirmation. Tap OK. Your card has been deactivated successfully. No one can use it.

Block Bank Alfalah ATM Card Using the App

If you lost your Bank Alfalah ATM card or need to block it, you can do it from your Alfalah Bank App by following these steps.

1: Open the App

- Open Bank Alfalah app.

- Enter your PIN or use TouchID / FaceID to log in.

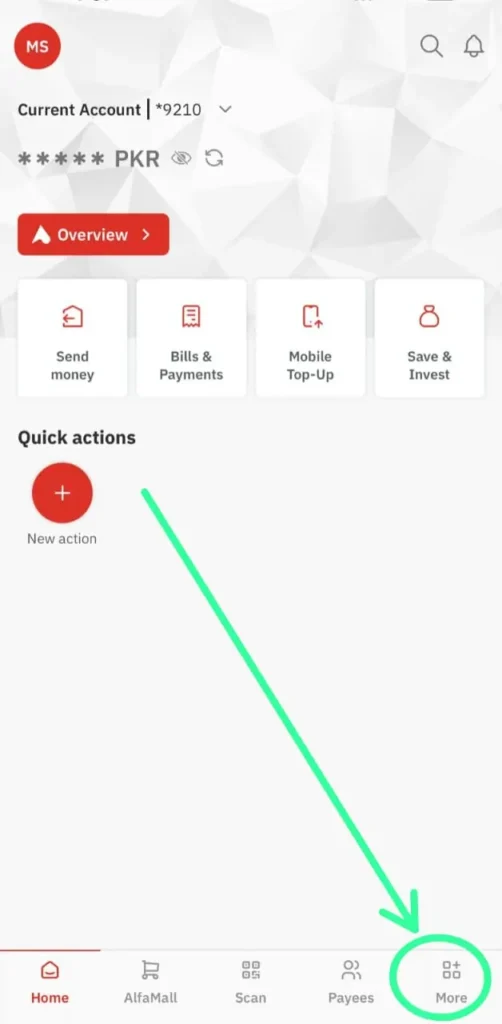

2: Find the “More” Button

On home screen, look at the bottom right corner for More, Tap to see more options.

3: Tap on “Cards”

In the “More menu”, scroll down and find Cards. Tap to open your card options.

4: Press “Lock Card”

Below card, find the button that says “Lock Card”. Tap to block card.

5: Confirm to Lock Your Card

A pop up will appear asking if you want to lock the card. Tap Lock Card again for confirmation.

6: Card is Locked!

Card locked successfully! Your card is now blocked, and no one can use it.

Block HBL ATM Card Using the App

Block your HBL Debit/Credit Card by using HBL Mobile App. Just follow these steps:

1: Log In to the HBL App

- Open the HBL Mobile App on your phone.

- Enter login ID and password, or use the TouchID / FaceID if enabled for quick access.

2: Open the Menu

Tap on the three lines in the top left corner to open the menu.

3: Go to Management & Services

Scroll down and tap on Management & Services.

4: Find Card Management

Tap on Card Management from the list.

5: Select Your Card

In the Debit Cards section, pick the card you want to block.

6: Block Your Card

- Tap the Block button below your card details.

- Select a Block Type (like temporary block).

- Choose a reason from the list.

7: Confirm Blocking

- Tap the Block button to finish.

- A message will pop up saying your card has been blocked successfully.

Your HBL ATM card is now blocked, and no one can use it.

Block HabibMetro ATM Card Using the App

If you lost your HabibMetro ATM card or want to stop someone from using it, you can block it using HabibMetro Insta app. Follow these steps:

1: Open the HabibMetro App

- Open the HabibMetro Insta App on your phone.

- Type your username and password or use TouchID / FaceID to log in.

2: Tap on Menu

After logging in, find the Menu button at the bottom right and tap on it.

3: Select Cards

In the menu, scroll down and tap on Cards to manage your ATM card.

4: Choose Card Management

In Cards section, tap on Card Management to deactivate your card.

5: Check Your Card Status

- You will see your card’s current status, like Active.

- Tap on “Active”

6: Pick Temporary Block

Tap Select Status and choose Temporary Block from the list.

7: Enter Your PIN

Confirm by type your security PIN (Your card ATM Pin).

8: See the Success Message

After confirmation, you will see a message that says, “Card status successfully changed.” Your card is now blocked, and no one can use it.

Turn Off SadaPay Card Using the App

SadaPay offer virtual and physical cards seperately, to block either of them, follow these steps:

1: Open the SadaPay App

- Open SadaPay app on your phone.

- Enter your PIN code to log in.

2: Find Your Card

On the main screen, tap on your Current Balance to see your card details.

3: Freeze Your Card

- Under the My Cards section, select Physical Card or Virtual Card.

- Tap Freeze Card switch to turn it off.

4: Confirm Card is Off

The toggle switch is on, this means your card is now deactivated and can’t be used.

How to Turn Your Card Back On

- To reactivate your Sadapay card, Open Sadapay app

- Login with your number and pin

- Go to My Cards.

- Tap the Freeze Card switch to turn it back on.

- The toggle switch is off, and your card is activated.

Learn How to Open Digital Wallets Without Owning the SIM

Signs Your Whatsapp Business Account is Blocked

Block NayaPay Card Using the App

If you lose your NayaPay card or want to keep it safe, Use Nayapay app to deactivate by following these steps:

1: Open the NayaPay App

- Open the NayaPay app on your phone.

- Enter your PIN code to log in.

2: Go to the Cards Section

- On the main screen, look for the Cards button at the bottom.

- Tap to see your card options.

3: Freeze Your Card

- Find the Freeze Card option and tap it.

- A pop up will appear, “Freeze Card”

- Tap Freeze Card again to temporarily block your card.

- Your card is deactivated and can’t be used until you unfreeze it.

4: Permanently Block Your Card (If Needed)

If your Nayapay card is lost or stolen, tap the Permanent Block button.

5: Confirm Permanently Block Your Card

- A pop-up will appear asking, “Block Card”

- Tap Block Card to permanently disable it.

You will need to request a new card from NayaPay if you want to use their services again.

Stay Safe from Card Fraud in Pakistan

Card fraud can happen to anyone, but taking a few simple steps can keep your money safe. Follow these tips to protect yourself from scams.

1. Keep Your ATM Card PIN a Secret

- Don’t tell anyone your PIN.

- Use a strong PIN like “5824,” not easy ones like “1234” or “0000.”

2. Save Your Bank Phone Number

- Save your bank helpline number in your phone.

- This helps you call them quickly if you need to block or stop a transaction.

3. Turn On Card Transaction Alerts

- Ask your bank to send you SMS or app notifications when your card is used.

- Alerts will help you know right away if someone else is using your card.

4. Check Your Account Often

- Look at your account balance and transactions regularly.

- Make sure no one is spending your money without your permission.

5. Tell Your Bank If Something Is Wrong

- If you see a problem, call your bank.

- Tell the problem and your bank will help any fraud activity and protect your money.

6. Get Extra Help Online

- Visit the State Bank of Pakistan’s Consumer Protection page.

- They have tips to keep your money and information safe.

Quick FAQs

Yes, call your bank or visit a branch to unblock it.

Blocking is free, but you may have to pay a fee for a replacement card.

Most banks take about 5–7 working days.

Yes, many banks let you block cards using their apps or websites.

Deactivating ATM card is one of the important thing we all should know to protect our hard earned money if card details is lost or stolen. Banks in Pakistan, like Meezan, HBL, and UBL, offers convenient ways for blocking, with mobile apps, helplines, and branch services.

Mmake it a habit to regularly check account for any suspicious transactions and keep ATM card blocked if not in used. If anything unusual happens, contact bank immediately to report the issue. Once the card is blocked, don’t forget to request a new one to continue enjoy living.

Umer Kureshi is the Lead Administrator with a strong background in technology and digital marketing. As the Lead Administrator, and Writer at Pakera.pk, Umer manages the website operations, optimizes website content and writes engaging guides on technology and current events happening in Pakistan.

Currently, Umer is pursuing a Bachelor’s in Management Studies from Government College University, Lahore. Umer combines his academic insight, knowledge, and critical thinking with practical experience to give impactful results. Umer also contributes to Xfilink Pvt Ltd as the Lead Writer of Content Writers Team and to Technology Elevation, where he looks over affiliate marketing, web design, technical writing and proofreading.

In his free time, Umer stays active and energetic by regularly participating in sports and outdoor activities, combining his athletic spirit with a passion for staying sharp and focused.

4 thoughts on “How to Block ATM Card in Pakistan: Quick and Easy Guide”